Modern uses of AI

In the modern era of digitization and automation, the use of Artificial Intelligence (AI) is increasingly prevalent. AI is known for its capacity to emulate human cognitive processes and execute complex tasks. With the emergence of big data, AI has become indispensable across various sectors, including healthcare, government, and accounting. In these domains, AI presents numerous opportunities, transforming standard data analysis tasks into predictive modelling exercises. These sophisticated tools enable the extraction of valuable insights from data, which previously required significant time and effort. However, the complexity of AI models often poses challenges to user comprehension. The decision-making mechanisms of these models are frequently opaque, leading to a lack of transparency that may hinder their adoption in these sectors. This combination of complexity and opacity is commonly referred to as the ‘Black Box’ phenomenon. It presents significant obstacles to user understanding and trust, thereby impeding the integration of these models.

About the author

This article is based on the outcomes of the master thesis of Bas Villevoye. He wrote the thesis for the Master of Information Management at Tilburg University.

Why this topic?

Difficulties in finding a suitable thesis topic? Bas gave a quote on how he found his thesis topic:

“I first looked at which subjects I liked most in IM. A professor had a subject in emerging technologies, and I came up with a number of ideas. In addition, I also have an affinity with the human aspect and the psychology of people. And especially with the rise of AI, I also found it an interesting direction.“

The importance of AI in the accounting sector

The accountancy sector is undergoing a significant transformation by integrating advanced analytical technologies, such as deep learning and big data. This development, characterised by a growing reliance on Artificial Intelligence (AI), requires reconsidering traditional approaches.

The research of Bas, which is conducted at Tilburg University in collaboration with Baker Tilly, focuses on a critical aspect of this technological integration: the trust of financial auditors in analytical models. A specific focus was the RGS-SyncMap model, a deep learning tool designed to predict the RGS classification of general ledger accounts. This model represents an advanced approach to data analysis within accountancy but also raises questions about transparency and comprehensibility for users, particularly accountants. The RGS-SyncMap is an internal project of the organization where Bas bas did his internship.

What is the RGS SyncMap model?

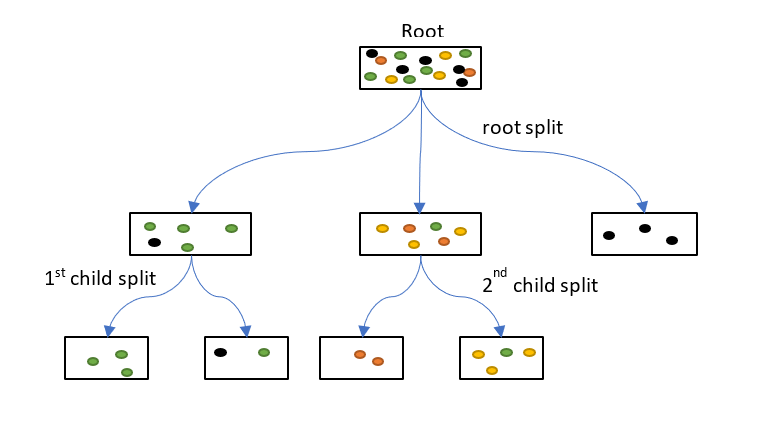

In the world of accountancy, many analytical models are available. In this research, one specific analytical model is investigated in more depth to gain valuable insights. The model that has been selected is the RGS-SyncMap model. The model is the result of prior research and focuses on classifying general ledger accounts to the RCSFI framework.

The RCSFI is a framework that utilises fixed codes to classify a certain general ledger account. The use and future adaptation of the RCSFI framework is a strategic move of the internship organization of Bas to be able to standardise the data analyses. Moreover, this classification can be used by auditors to improve financial data analysis.

The RCSFI is not a standardised framework in the Netherlands, and not all accounting software supports this standard. Therefore, auditors have to manually map all the general ledger accounts to the framework. This is a labour-intensive and time-consuming task.

The RGS-SyncMap model has been developed to predict an RCSFI classification for all general ledger accounts, in this sense aiming for automation. However, the correctness of the mapping directly impacts the data analysis and is therefore validated by auditors. In this way, the model can be seen as providing preliminary work to the auditor and supporting the classification process. The mapping of the RCSFI standard to the general ledger account can be seen as part of the planning phase of an audit

of financial statements.

In utilising a standard for data analysis like the RCSFI framework, the data from the customers needs to be mapped first to efficiently analyse the data. Deciding on the approach of the audit, for example by utilising the RCSFI framework, is part of the planning phase.

Research approach

The research combined qualitative methods with supporting quantitative data. This included semi-structured interviews with auditors and a developer of the model, aimed at gaining insight into their perceptions and levels of trust. The research findings were used to propose and evaluate concrete improvements in the model, particularly in terms of transparency and comprehensibility. This was crucial to answer the core question: “How can trust among financial auditors regarding analytical models be enhanced?”

Results and conclusion

The findings of the research were significant. It was found that increasing the transparency and comprehensibility of the RGS-SyncMap model led to a substantial increase in trust among accountants. This was achieved by integrating additional specific data, such as organizational typologies, and improving communication about the methods and techniques behind the model. The results also showed that the improvements had a particularly significant impact on comprehensibility, predictability, competence/reliability, and the development goal of a model according to Körber’s TIA model dimensions. The research emphasized that for strengthening trust in such complex models, a balanced approach between transparency and complexity is essential.

Opportunities for the accountancy sector

This research contributes to a better understanding of the dynamics between technological sophistication and user trust within accountancy. It provides new theoretical insights into the influence of transparency and comprehensibility on trust in analytical models. Practically, the research offers concrete guidance for companies like Baker Tilly on how such models can be effectively integrated into their audit processes. Implementing these findings can lead to more efficient, reliable, and standardized data analyses. Furthermore, the research encourages additional studies on optimizing analytical models in accountancy, which is vital for the continued evolution and improvement of the sector.