Whether you are aware of it or not, we have come dependent on a handful of internet companies. With almost 100% certainty you have used one of their products, simply because otherwise you were probably not able to read this article. The questions is, have these companies become too big to fail?

Before answering this question we need to dig in to some terminology, if you are not an investor you probably never heard of the FAANG, BAT or the MAAN and why should you? Well maybe you should, just because they are so important to us. Simply put these acronyms stand for a selection of stocks, hence FAANG stands for Facebook, Apple, Amazon, Netflix and Google (although that is now called Alphabet), MAAN stands for Microsoft, Apple, Amazon and Netflix and BAT stands for Baidu, Alibaba and Tencent. But why do we use these names? Well the FAANG was born since these stocks have something in common, they are the best performing tech stocks and are called growth stocks since their value increases almost steadily year on year. The other acronyms are just some competitor combinations, where the BAT is China’s equivalent.

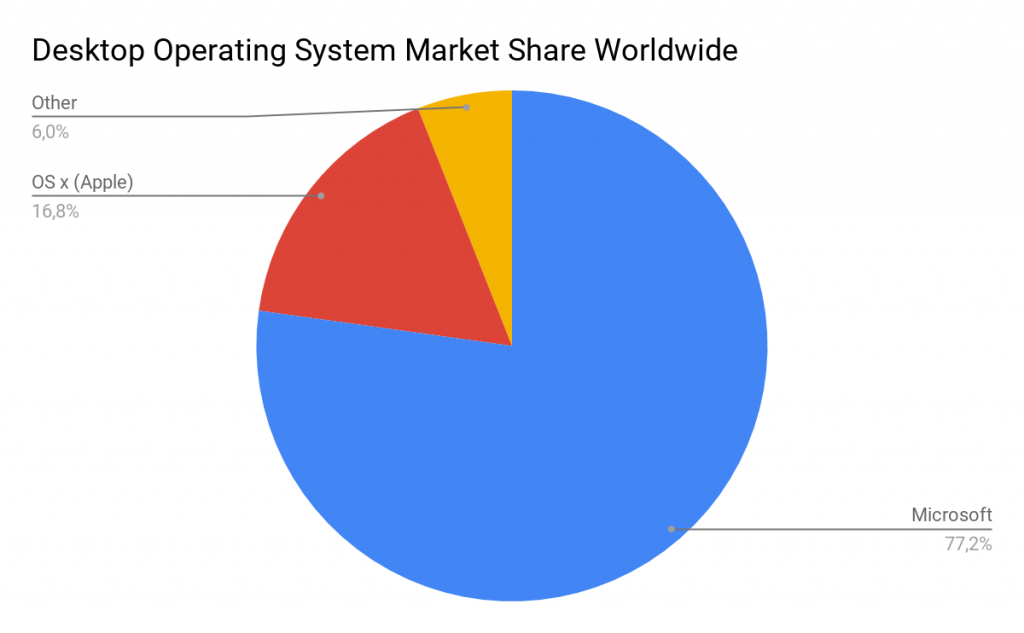

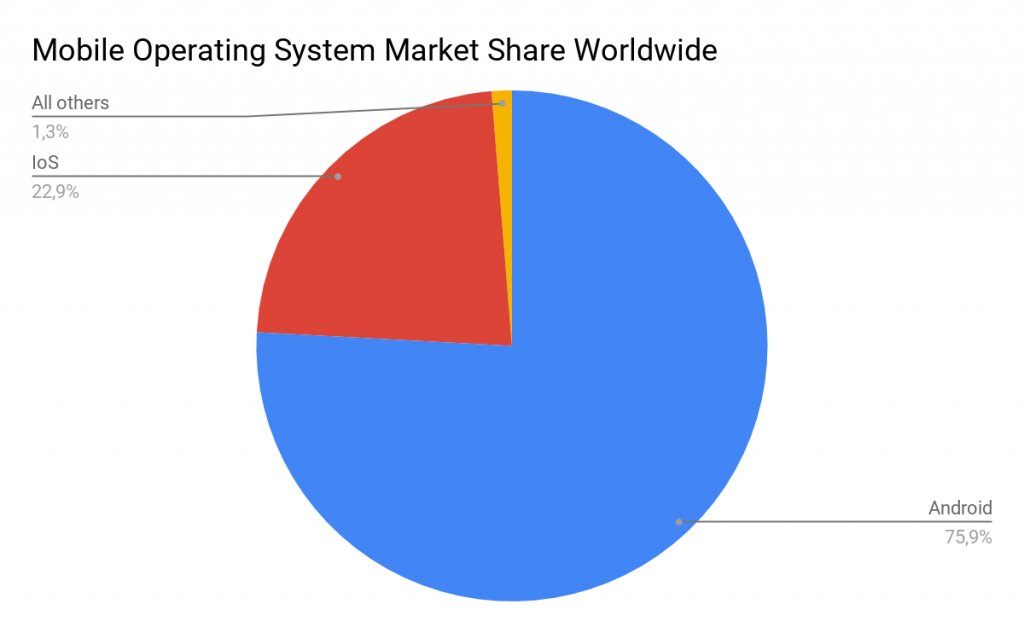

As told in the introduction you probably are using one of their products, if you are on a phone you either are using apple, or an android phone (which is owned by Alphabet/Google) since they together have about 99% market share in phone operating systems market. One may think there was a time there was a battle between more platforms/companies. Although this is true, the only smartphone competitor that had quite some market share was Microsoft, which is basically just another big tech company. So if you are using a computer you think you are better off, this is true, but just marginally. The Desktop operating system market is dominated by Windows (microsoft) and Mac OS(Apple), their dominance ranges from 94 tot 97%, so the total operating system market is dominated by Microsoft, Google and Apple (96-97%). So yeah there is a possibility that you are not using a product from these companies (your among the 3-4%) just to get here but is seems very unlikely. Not to even start on which browser, search engine or web host you are using.

When looking at other markets, we find similar but less extreme cases. The web browser market is dominated by Google, Apple and some extend Microsoft. The search engine market is dominated by Google and, to some extent, Microsoft. But also the cloud is dominated by Amazon, Microsoft and Google. Well the list goes on, but you will see they especially dominate the tech market. Special attention should be paid to Facebook, although they are relatively new to this landscape, they’re quickly becoming dominant in the social media world. Of course they own Facebook, but they also own Instagram, Whatsapp and Messenger, all of which have more than 1 billion users. In total Facebook counts around 2.5 billion users, that is close to 1 out of every 3 humans on earth (numbers no one can compete against). Especially, since there exists a networking effect on social media, you want to go where others are too. Hence, going to another platform is even less likely.

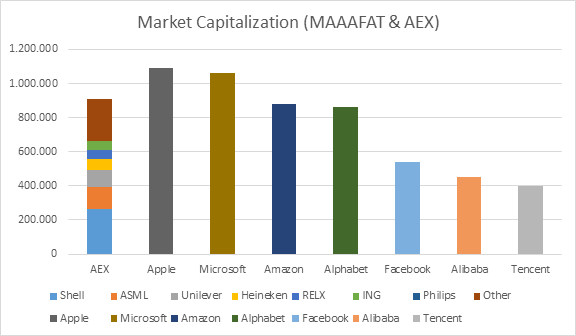

The question we’re looking to answer here, have these companies become too big to fail? This term “too big to fail” is a term that was widely used for financial institutions in the crisis. If one of them would fail, what systematic risk to the financial sector would they cause. Hence, would the costs of their failure be greater than the costs required to save them? For this, we need to look at several factors. First let’s determine with which companies we are looking at. Although the FAANG do have a lot in common, it feels wrong to exclude Microsoft here. Actually, it feels like Microsoft, Alibaba and Tencent belong here more than Netflix does, as Netflix is still a relatively small player. Whereas Alibaba is similar to Amazon, Tencent has more in common with Facebook (especially with whatsapp). So let us dubb a new acronym, the MAAAFAT; Microsoft, Apple, Amazon, Alphabet, Facebook, Alibaba and Tencent. We are thus not considering Netflix and Baidu, since they are a relatively small companies in comparison to the others. So what is small? Well Netflix has a market capitalization of about 120 billion. Tencent being the smallest of the others has about 400 billion.

Some more elaboration on the market capitalization is valuable for the general understanding of the situation. The MAAAFAT are 7 of the 9 most valuable companies in the entire world. Yes these predominantly tech companies are dominating our world. The only company from the 8, which is not included, is Berkshire Hathaway, which is an investment company and has a stake of $50 billion in Apple, and Saudi Aramco who just went to the market. The market capitalizations of these companies are as follows: Apple $1.09 trillion, Microsoft $1.06 trillion, Amazon $880 billion (all of these three companies have crossed the $1000 billion mark and ranked #1 on market value at some point in time). Continuing, Alphabet $860 billion and than the relative smaller ones Facebook $540 billion, Alibaba $450 billion and Tencent about $400 billion. Those numbers are probably a bit vague, so let’s compare them to our own stock market. All the companies together in the AEX, which includes well-known companies like Shell, Unilever, ASML, Heineken, Philips, ING and many more (24 in total) are worth around $930 billion together, roughly the same as one of the largest from MAAAFAT.

At the time of the financial crisis, the “too big to fail” companies of that time did not even come close to these numbers, neither were they as dominant. So in that sense these companies have grown far beyond too big to fail. Imagine if a company worth a $1000 billion suddenly goes bankrupt, meaning that other companies and people lose this value. Many more companies will go bankrupt, people would lose significant amounts of money. Besides, if such a company can fail, distrust will spread quickly, just as it did during the financial crisis. Whether it is $1000 billion or $400 billion, if one of the 9 most valuable companies goes bankrupt, there will be huge consequences.

So yes, in financial terms these companies have grown to be too big to fail. But, we are actually more interested in what will happen if their infrastructure disappears. Prior we have been talking about their dominant position in several markets, and from this point we will work from there. Although these companies have a lot in common, it becomes interesting to go over what influence they have on our lives one by one.

Let us start with Apple, by now the second most valuable company, famous for their iPhone, iPad, Macbook, but also the iPod, iWatch and iTunes. How dependent of Apple have we become? The conclusion that a bankruptcy of apple would cause a huge problem financially has been made, but what about our services. Hundreds of millions of people use an iPhone, iPad or Macbook. But also iCloud, the App store and many more products are dependent on their mother company, Apple. If Apple would go bankrupt you will no longer have warranty, the app store and iTunes would no longer be supported, your product would no longer be updated and you would become prone to malware. Your cloud services will go offline, the Apple browser (Safari) will stop working and many more services will be disrupted. Of course, some companies will try to overstep some of these issues. You can buy another computer or phone, but the world is not ready to take up that production, recovery will take months, companies will no longer be able to use their products, they need new licenses, support desks must learn to work with new operating systems, and so on. Summarizing, with Apple’s bankruptcy will result in a gigantic problem in the tech world, billions will be lost at other companies and recovery for individuals and companies will be problematic. YES apple has become too big to fail

Apple might be a bad omen with regards to the other companies. Where we have millions of Apple fanatics, there are less Microsoft fanatics. However, our dependency might be bigger, because when buying a computer you almost certainly use windows and it is even more likely to use Office products (like Word, Excel and Powerpoint). Yes there are alternatives, but no one can work with them, Apple has their own set of utilities but it only works on Macbooks, Linux works fine on the same computer, but certainly most people will not be able to work with it. Hence, our dependency on Word, Excel and Powerpoint is huge, there are several competitors in the market, though they work differently. Yes, it sounds like a pure apocalypse, but when support for Window XP ended, many companies got in trouble. Imagine what will happen if all support ends. Servers, web hosting and several other services (like LinkedIn and Github) will stop working. Most companies can barely execute anything, everybody must be re-trained and things will almost stop moving entirely. The difference being that Microsoft provides less of a structural demand to their suppliers (since it is a software company, they have significantly less suppliers compared to a hardware company). Thus, less suppliers are dependent on its demand. However, no mistakes are to be made, it is certainly too big to fail, maybe even more so than apple, due to its operating systems, Azure and Navision.

If we look at Amazon then we are looking at quite a different type of company. Whilst they initially were an online marketplace for books, they have now expanded into many areas (such as cloud computing, E-commerce). Their core business is obviously their webshop, but they are also an important player in the cloud market. Although financially it would definitely be too big to fail, it seems that there is higher possibility that their business, although huge, does not necessarily have to be accounted for as too big to fail. Yes the cloud market will get a huge shock, but there are quite a lot of competitors. A lot of websites will have troubles (Netflix for example) and it will be chaos, but most business and life will be able to continue and can quickly be taken care of by a competitor. Of course it will become a more difficult to buy goods online, but the physical network of stores is still present and there are competitors in the market that can flourish now. Although life might get harder for some, it does not seem that everything will go wrong. Although Massive, Amazon does not seem too big to fail.

Another giant created by the internet world, is Alphabet, where the main part is Google. So before even going in to dept let us consider what services we should consider. First of all we have the search engine google but also services like gmail, google maps, google drive, chrome and google calendar are widely used products. So what will happen if Alphabet would fail, well searching the web through google will no longer be able, many people will lose their email, navigation will break down, managing your agenda will be troublesome and you might need a new browser. However, for all of these services, alternatives are readily available. Many other search engines exists (whether they are better or not is a discussion for this article), but also competitors for email services, browsers and agenda’s exists. Maybe the biggest impact would be google maps, although there are competitors, the massive collection of the data for maps is expensive and few rivaling networks exists. However, there are some competitors (like TomTom). So for all of these services rivals exist and searching the web through another search engine will make us find our results differently, but in essence it will not create chaos. Switching to another email is different, but in essence an email server works the same (especially since a lot of companies already work with outlook). Maybe the biggest chaos will be on routing, competitors might not be able to handle the new users, so people have to navigate the old fashioned way again. It might lead to more mistakes and some people getting lost, but eventually the chaos created will be limited. Maybe surprisingly (thinking about how much we use it) Alphabet has not become too big to fail.

Will our social media giant Facebook switch this around again and be too big to fail? Well there are clear signs they might be. With around 2.5 billion users it has a huge impact, it is the appearance platform for most companies and actually so many services are connected to it that a collapse of this giant should almost certainly create chaos. Although we might be addicted to social media, we are not completely dependent on it, we do not need Facebook. It is one of the ways we stay in contact with many people, messages get spread easily and you can convey your message quickly. Organizing an event might be harder without creating a Facebook event, but the old fashioned way or reaching out to people still exists. The downfall of whatsapp might actually influence more lives than the downfall of Facebook. Many people do not use other messaging platforms than WhatsApp, so what happens if WhatsApp goes bankrupt? A like to the some of the earlier cases, enough competitors exists in this field, together they will be able to take care of a lot of users. Also the old fashioned sms does still work, we still have email and if we combine this by competitors we can quickly make up for this problem. Hence, there will be short lived chaos, but it will be contained quickly. Another NO.

After making the case for Amazon we can make a similar case for Alibaba. Certainly, products might get more expensive when the cheap competitor disappears, but there are competitors in the market, and the local shops will flourish. So NO Alibaba is not too big to fail.

Then we reach our final company, although probably less known, it is a true social media giant in China, we are talking about Tencent. The most striking of these might actually be WeChat, but also QQ IM is very important. Both are chatting tools, thought QQ is for messages on desktops, while Wechat is an app more similar to Whatsapp. But it also owns major stakes in gaming companies, e-commerce and many other branches. However, for now we stick with WeChat for the evaluation (though the valuation of the company is also largely derived by the gaming revenues). WeChat is more than just a chatting platform, connected to WeChat is a payment platform, a social media platform (similar to Facebook) and even a trading platform (comparable to Ebay). WeChat is called a “Super app” for a reason. It has integrated so many services in one, that you can do almost everything with it. Although it’s primary market is China, it still has a huge potential with a growing dominance of China in the world market. A shutdown of WeChat would cause huge problems in China, since so much is connected, yet there are competitors, but nothing is integrated to take care of this shutdown. Business will respond quickly and other alternatives will thrive. Imagine though if 50% of the Chinese population can do just 50% less for only 4 months, that is 25% of the Chinese economy shut down for 4 months. Nothing is prepared for such a massive impact. Chaos will be spread mainly in China and will in lesser extend hit the rest of the world (though so much is related). So maybe surprisingly Tencent fits the scale of too big to fail, although less certain.

So what can we conclude? Well some of the MAAAFAT are truly too big to fail, if their business would go down due to a bankruptcy, chaos will be widespread and the impact will be enormous. However there is also hope, not all of the MAAAFAT companies are strictly necessary and we would survive without their services through the rise of their competitors. Though one thing seems certain, financially their bankruptcy might cause way more problems than just their services, as famously said “when confidence goes, confidence goes”. As soon as one of the world’s 9 largest companies can go bankrupt, anything can happen, panic will spread and causing the investment market to plummet, resulting in various other companies having serious issues to keep operational. This would lead to a crisis we certainly would not want to take a risk upon. Although, by putting one of these companies slowly to rest, we could certainly ensure that most of their services will be taken over. Yet, the impact that one of them goes down might be more in the unbelief than in the direct impact. Therefore, the MAAAFAT has become too big to fail.

So what should we do next? Well that is a harder question to answer, to try to break up these companies will remove much of their synergies and might take away their competitive advantage, causing the very undesired failures of them by a self-fulfilling prophecy. Maybe it’s more important to acknowledge that these companies became giants for a reason. They all have hugely profitable components, that for some cases subsidize the other components. Since they are so profitable at the time, it seems very unlikely that they will suddenly go bankrupt, as long as they stay in their business and manage their risk. So maybe good supervision (from government organizations) might be better than a call to split these giants.

No longer using their products does not seem to be a solution either, they have already grown too big. Though one could consider not using their products for many other reasons, as these companies are driven by one very important aspect, they own a lot of data about you. So you might consider not using their services and avoid the big brothers watching you. This however, can be a topic for a different time. For now, we conclude that the MAAAFAT has become too big to fail, though splitting the giants might be more risky, adequate supervision seems to be a safer possibility of managing the risk concerned with their downfall.

1. What Are FAANG Stocks? (2022, March 23). Investopedia. https://www.investopedia.com/terms/f/faang-stocks.asp

2. D. (n.d.). BAT vs FAANG: The battle for digital dominance. IBC. https://www.ibc.org/trends/bat-vs-faang-the-battle-for-digital-dominance/3103.article

3. Mobile Operating System Market Share Worldwide | Statcounter Global Stats. (n.d.). StatCounter Global Stats. https://gs.statcounter.com/os-market-share/mobile/worldwide

4. Desktop Operating System Market Share Worldwide | Statcounter Global Stats. (n.d.). StatCounter Global Stats. https://gs.statcounter.com/os-market-share/desktop/worldwide/

5. Operating system market share. (n.d.). Netmarketshare.Com. https://netmarketshare.com/operating-system-market-share.aspx?

6. Operating System Market Share Worldwide | Statcounter Global Stats. (n.d.). StatCounter Global Stats. https://gs.statcounter.com/os-market-share