Cryptocurrencies are a digital form of value transaction which has the potential to transform the way value is perceived and utilized. The market is growing at a rapid pace and is extremely volatile. During the writing of my MSc thesis on Blockchain adoption alone, the market capitalization of all cryptocurrencies has grown 470% (!) from $170 billion the 23rd of October 2017 to roughly $800 billion the 6th of January 2018 [1]. This growth felt unsustainable. After a combination of unfortunate events, the imminent correction finally occurred. Big time. As of the 24th of January, the total market cap is around $540 billion [1].

WHAT IS A BUBBLE, WHY DOES IT OCCUR

Now that we have seen some data, let’s talk about the general definition of a bubble. A bubble is the sum of all overvalued goods or services in a new upcoming industry. The bubble bursts when individuals start realizing what the intrinsic value of a certain good or service is compared to this overvaluation. Current (over)valuation – intrinsic value = Bubble [2]. Simple, right? However, the reason why a bubble exists is because it is hard to determine the intrinsic value of a (n internet-based) company that is not listed on a stock exchange. The value is an estimation [3]. The news of price increases by early investors creating word-of-mouth stories cause new investors to add to successive feedback loops as the bubble grows [2]. So, are we in a cryptocurrency bubble?

ARE WE IN A BUBBLE?

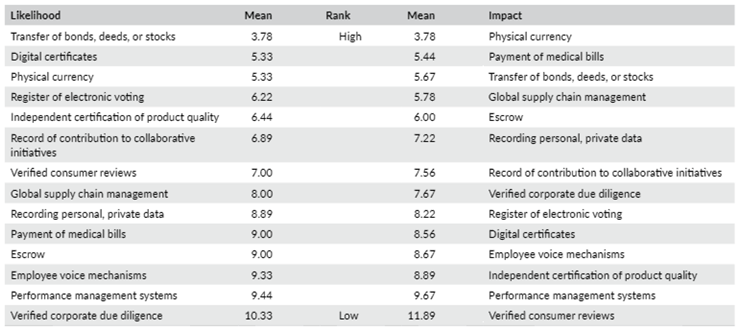

Nobody knows for sure. My gut feeling leans more towards yes than no, but my rational side tells me that that does not mean anything. From a technological perspective, the Gartner Hype Cycle [4] states that Blockchain in general is in the “Peak of inflated expectations” phase, entering the “Trough of disillusionment” phase during the writing of this article. Gartner states that long-term, the technology will lead to a reformation of whole industries, but current issues clouding the technology keep it from mass adoption. I would say it requires a more versatile approach, as this does not give us any answers as to which extent Blockchains intrinsic value is already realized as opposed to its current monetary evaluation. Well, what is Blockchains’ intrinsic value then? This is where speculation comes in. To make it as solid as possible, a peer-reviewed Delphi-study by White [5] is used. White concludes on a list of possible applications of Blockchain and their likelihood to be realized, which are given in table 1.

Table 1: List of possible applications by White (2017)

A low mean represents a high likelihood of occurring in the future. Market capitalization is used as a metric to determine total worth. This does not necessarily mean that the entire market cap of all transfers of bonds, deeds or stocks could be directly taken over by Blockchain based solutions, at least not in the beginning. I would however say that stocks are a very appropriate and interesting application of Blockchain, as we have seen with Ethereum, which is just the first kid on the block. Many other smart-contract Blockchain platforms support Initial Coin Offerings (ICO’s) on their platforms. Participating in an ICO could be roughly translated into buying a share into a company. The entire global stock market capitalization lies around $65.6 Trillion as of October 2016 [6] as opposed to $0.54 Trillion [1] of the entire cryptocurrency market capitalization. That’s less than 1% just for stocks. This figure does not include bonds and deeds, the real market capitalization is therefore even higher. But, for the sake of caution, let’s only use stocks. But what guarantee do we have that ICO’s are going to consume the stock market?

Nothing is guaranteed until it happens. All ICO’s promise to deliver a certain added value, for which the cryptocurrency can be used to facilitate using that value once the project is finished. A lot of projects do not have an appropriate value proposition that solves a problem for a target group, but do have a lot of marketing driving up the price. This, and ponderous regulators which are until now mostly unable to regulate fraudulent or amateur Blockchain-related projects, cause the risk of investing to be high. However, a limited supply of a certain cryptocurrency and a high demand leads to high returns. High returns, increasing technological robustness, properties and according competitive advantage could cause projects funded by ICO’s to grow as investors now have a stake in making sure its value remains high. So these projects could not only disrupt the stock market, but also all other sorts of markets and enterprises [7].

So, to come back to the question of whether we are in a bubble, most probably. But the bubble is still very early stage and shows much larger potential as opposed to the dot.com bubble which reached 5 Trillion, just for North-America [8] instead of global as is the case for Blockchain, which has a much wider range of applications and possible markets to address. Furthermore, bubbles begin to appear when credit is abundant and an economy is doing well [8]. Just coming out of a global recession, my estimate would be that the bubble has not yet reached its full capacity.

BUT WE HAVE ALL THESE PROPERTIES OF PREVIOUS BUBBLES, RIGHT?

Yes. The following properties are examples:

- As imitation spreads across inexpert publics, knowledge degrades.

A saying which is aligned with this property, and with how I feel sometimes when people ask me questions regarding Blockchain is: ‘’In the land of the blind, the one eyed man is king.’’ There seem to be not a lot of people who actually know what they are investing in, which concerns me. However, ‘’A market ‘‘correction’’ shakes out all ‘‘speculators’’ and directs a return to legitimate, rational first principles, requiring that true worth be assessed by return on investment, a proper institutional logic. Thus, a downward spiral is said to return a market to its natural equilibrium. At the time, such a rationalization proves less than satisfying. ‘’ [8] I believe that these corrections happen more often in crypto, and occur when a cluster of negatively influential factors are combined in a short period of time, as I will elaborate upon later in this article.

- IPO’s versus ICO’s

During the dot.com bubble, we experienced a dramatic increase of Initial Public Offerings, or IPO’s, which show comparable properties to ICO’s [8]. This concerns me. I believe that a lot of ICO’s do not know what value they are creating for who, and in combination with the fact that a lot of people do not know what they are investing in, I believe that a large part of ICO’s are deemed to fail. I believe that corrections will partially shake out those that are fraudulent. A larger issue is those that overextend their marketing as opposed to actually creating value through technology, and as opposed to their actual knowledge level on creating cutting-edge innovations.

- Almost all new technologies tend to go through a bubble

Alan Greenspan called the over reactive price action on innovations ‘’Irrational Exuberance’’. Nothing important has ever been built without it [9]. Overinvestment create opportunities for failure, which could cost the lazy investor and profit the savvy investor.

There are most probably a lot of other comparable properties. The point that I want to make here, is that we are most probably in a bubble.

SEVERAL FACTORS, OR A CLUSTER OF THESE FACTORS, COULD CAUSE THE CRYPTOCURRENCY BUBBLE TO BURST, AT ANY TIME.

Growth will undoubtedly correct several times. The following examples could be reasons, and a cluster of these or similar factors could cause a big correction that could be named as the ‘’bubble bursting’’.

- First of all, most ‘’investors’’ stepping in are emotional over rational, and never invested a penny before [2]. These investors are attracted by profit rather than intrinsic value, thus creating a speculative bubble. These “weak hands” will lose the most. This is comparable to the dot.com bubble [8].

- Second, all growing markets are prone to corrections simply because investors want to take profits at a certain level.

- Third, fraud is influential in new sectors where ponderous regulators did not have time to create a regulatory framework yet. If a fraudulent organization decides to exit the market, this could leave a hole in the entire sphere. This was predicted to happen to BitConnect [10], which seems a correct prediction as the exchange rate went from a 2.5 billion market cap towards $136 million in one day [1].

- Fourth, governments have a large influence. If news comes about concerning a certain government banning or restricting cryptocurrency-related processes, this negatively influences exchange rates as well.

- Fifth, Security issues. As we have seen with Mount Gox, security issues can have a substantial detrimental impact on exchange rates [11].

CONCLUSION

To conclude, a cluster of these factors could cause the bubble to pop at any time. I believe however, that the full potential of Blockchain has not been reached for a considerable time yet. I believe that these factors are just hurdles on the road until its full potential is realized. I do believe that financial markets are ahead of the actual state of development, and that the bubble could therefore pop before the potential is realized. So, my own conclusions, and I am not a financial advisor, are:

- ALWAYS Do Your Own Research (DYOR) when (considering) investing. If we are all knowledgeable and able to estimate intrinsic value to some extent, the bubble will reduce in its negative impact on people’s lives. Look for projects solving real-life problems for real-life situations, or projects that have a very compelling solution to solving a future problem.

- I believe that there is much growth to come when comparing total possibility of applications with current availability of applications.

- The complexity issue and unknowledgeable investors are substantial issues which need to be addressed by regulators, investors and Blockchain projects.

- Investing remains risky due to weak-hands. Therefore, take your profits on a regular basis, preferably partially from projects that are going “to the moon”. A correction is imminent. Do not take all profits, but just a part. The ratio you take should be determined by the belief that you have in this organizations’ future added value in society. The part you take can then be used to either “buy the dip” of that same currency or another one, in either fiat or crypto. You can also choose to transfer it to fiat (or subsequently brick and mortar) as it is a safer haven.

- As a Blockchain project, NEVER overextend your marketing as opposed to the actually created value.

As someone who wants to contribute to speeding up the adoption of Blockchains added value, please feel free to ask me anything, criticize anything, preferably in a constructive way as this is my second article on Blockchain (did write an MSc thesis on adoption though). If this article leads to any healthy constructive discussion I see my time and effort invested in it as worth it.

Disclaimer: I am not a financial advisor. Do Your Own Research. I have long, mid and short –term positions on the following cryptocurrencies: IOTA, ADA, SPHTX, BTC, ETH, AE, VEN, WTC, POWR, ICX, WABI, AION. Whether they are long, mid or short could change. I distributed amounts accordingly to risk-ratio’s, added intrinsic value, fundamental analysis and technical analysis. Some (if not all) currencies in the list above have HIGH RISK. Some have been bought before this way of analysis was known to the writer of this article. I will not tell which ones so DYOR.

[1] Coinmarketcap. (2018, January 6). Retrieved from Coinmarketcap charts: https://coinmarketcap.com/charts/

[2] Macedo, J. M. (2017, November 29). Medium.freecodecamp.org. Retrieved from Medium: https://medium.freecodecamp.org/are-we-in-a-cryptocurrency-bubble-a-comparison-with-the-2000-dotcom-bubble-a463d8dd8d8b

[3] Flanc, J.-B. (2014). Valuation of Internet Start-ups: An Applied Research on How Venture Capitalists value Internet Start-ups. Hamburg: Anchor Academic Publishing.

[4] Kasey Panetta. (2017, August 15). www.gartner.com. Retrieved from Smarter with Gartner: https://www.gartner.com/smarterwithgartner/top-trends-in-the-gartner-hype-cycle-for-emerging-technologies-2017/

[5] White, G. R. (2017). Future applications of blockchain in business and management: A Delphi study. Strategic change; Briefings in Entrepeneurial Finance, 439-451.

[6] Ycharts. (2018, January 19). Retrieved from ycharts.com: https://ycharts.com/companies/AMZN/market_cap

[7] McConaghy, T. (2017, June 6). BigchainDB. Retrieved from blog.bigchaindb.com: https://blog.bigchaindb.com/tokenize-the-enterprise-23d51bafb536

[8] Goodnight, T. G., & Green, S. (2010). Rhetoric, Risk, and Markets: The Dot-Com Bubble. Quarterly Journal of Speech, 115-140.

[9] Shiller, R. (2014, August 23). Definition of Irrational Exuberance. Retrieved from irrationalexuberance.com: www.irrationalexuberance.com

[10] satoshiwatch.com. (2017, July). Retrieved from Satoshiwatch: https://satoshiwatch.com/hall-of-shame/bitconnect-coin/articles/bitconnect-scam-exposed/

[11] Coindesk. (2017). Retrieved from coindesk.com: https://www.coindesk.com/category/companies/exchanges/mtgox/